Trading Strategy Backtesting & Validation Systems

We build custom backtesting systems that help traders evaluate strategy behaviour, risk exposure, and execution assumptions — not tools that promise future profitability.

Backtesting is a critical step in strategy development, but only when done correctly. Our focus is on creating backtest systems that reflect realistic market conditions and clearly expose where a strategy performs well, where it fails, and why.

Who This Service Is For (And Who It Is Not)

This service is suitable if you:

- Have a rule-based trading strategy and want to validate it objectively

- Understand that backtests reveal behaviour, not guarantees

- Want visibility into drawdowns, trade distribution, and risk

- Prefer data-driven evaluation over intuition or assumptions

This service is NOT suitable if you:

- Are looking for backtests to justify a preconceived belief

- Expect historical results to predict future profits

- Want curve-fitted results without robustness checks

- Assume backtesting eliminates real-market uncertainty

What Our Backtesting Systems Cover

- Rule validation: Verifying that strategy logic behaves as intended.

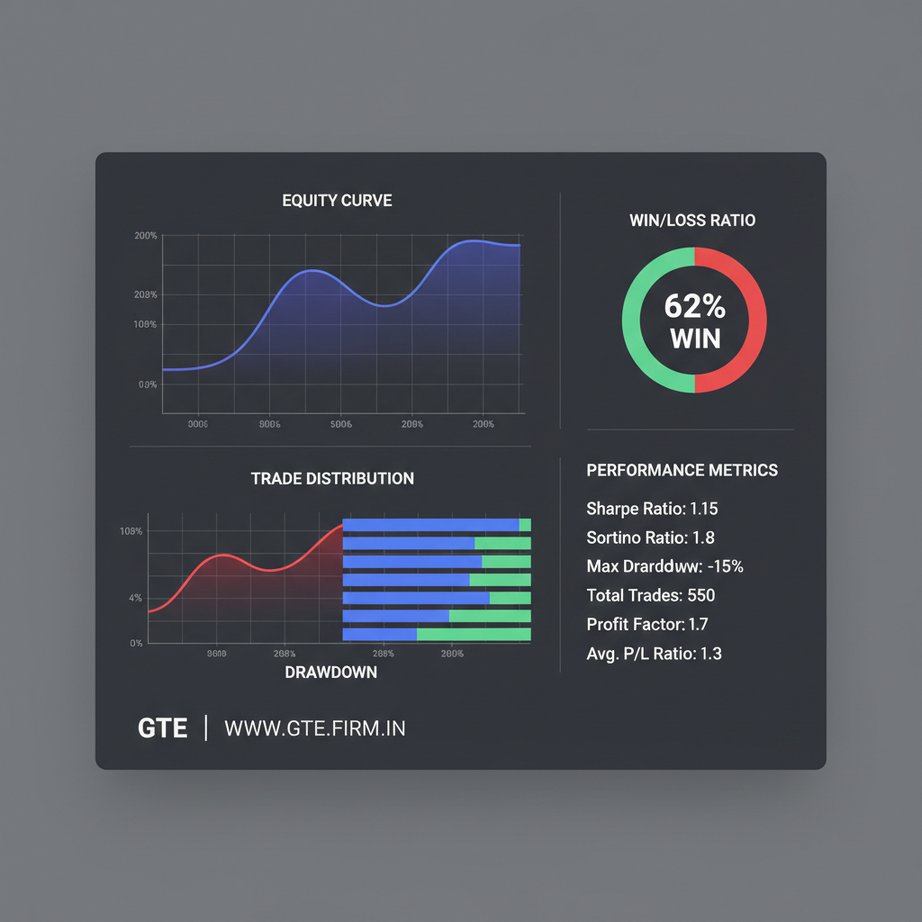

- Performance metrics: Equity curves, drawdowns, win/loss ratios, and expectancy.

- Risk analysis: Exposure, streaks, and adverse scenarios.

- Trade-level diagnostics: Entry, exit, and execution assumptions.

- Robustness checks: Sensitivity to parameters and market conditions.

How Backtesting Is Implemented

- Strategy rule definition and assumptions documentation

- Historical data selection and validation

- Backtest engine implementation

- Performance and risk analysis

- Interpretation and refinement guidance

Important Limitations You Must Understand

- Backtests are based on historical data, not future conditions

- Execution assumptions can significantly affect results

- Overfitting can create misleading performance metrics

- Live trading introduces slippage, latency, and liquidity effects

Why Work With Group Technologies & Exports

- Focus on validation and understanding, not selling performance

- Clear explanation of assumptions and limitations

- Experience across multiple strategy types and markets

- Backtesting systems designed to support real decision-making

Discuss Your Backtesting Requirement

If you want a clear, honest evaluation of how your trading strategy behaves under historical conditions, you can get in touch for an initial discussion.

No predictions. No guarantees. Just structured strategy validation.