Custom Algorithmic Trading Software & System Development

We design and build custom algorithmic trading systems for traders who want disciplined, rule-based execution — not black-box promises or “guaranteed profit” scripts.

Our focus is on converting clearly defined trading logic into robust, testable, and automatable systems that can operate reliably across market conditions, brokers, and instruments. The objective is consistency, transparency, and control — not hype.

Who This Service Is For (And Who It Is Not)

This service is suitable if you:

- Already trade manually or semi-automatically and want systematic execution

- Have a defined strategy idea and want it engineered properly

- Understand that drawdowns and losing periods are part of trading

- Want clarity on how a strategy behaves in live market conditions

This service is NOT suitable if you:

- Are looking for guaranteed profits or fixed monthly returns

- Want to buy ready-made strategies without understanding risk

- Expect automation to eliminate losses entirely

- Are unwilling to accept real-market execution constraints

Our Algorithmic Trading Software Development Services

- Strategy logic engineering: Translating discretionary or rule-based ideas into precise, machine-executable logic.

- Custom algo software development: Building systems tailored to your instruments, timeframe, and broker infrastructure.

- Backtesting & validation: Testing strategies on historical data with attention to overfitting, survivorship bias, and data quality.

- Optimization with constraints: Improving robustness instead of curve-fitting for ideal historical results.

- Live execution & monitoring logic: Handling order placement, alerts, failures, and operational edge cases.

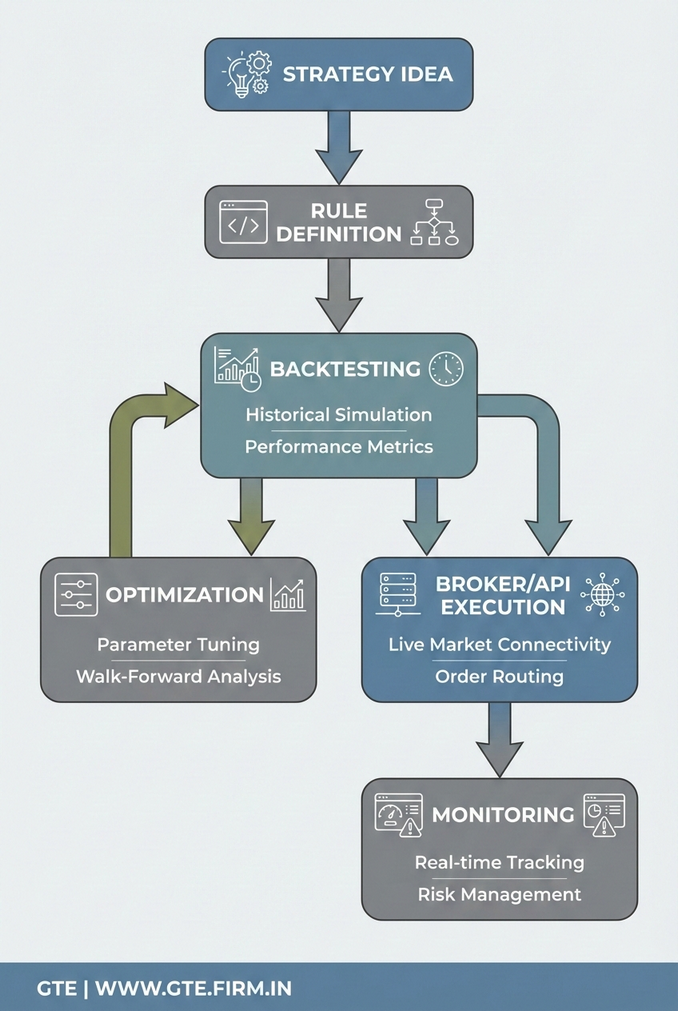

How We Build Algorithmic Trading Systems

- Strategy discussion & feasibility assessment

- Rule definition, assumptions, and risk documentation

- Backtesting and robustness checks

- Automation and broker / API integration

- Live deployment support and iterative refinements

What You Gain From a Properly Built Algo Trading System

- Consistent execution without emotional interference

- Clear visibility into strategy behaviour and risk exposure

- Ability to scale trades systematically and repeatably

- Decision-making driven by logic, not impulse

Why Work With Group Technologies & Exports

- Focus on system design and engineering — not script selling

- Clear discussion of risks, limitations, and assumptions

- Experience with TradingView, scanners, APIs, and broker integrations

- Custom-built solutions instead of one-size-fits-all products

Discuss Your Algorithmic Trading Requirement

If you have a strategy idea or an existing trading process that you want engineered into a reliable algorithmic system, you can get in touch for an initial discussion.

No guarantees. No hype. Just structured system development.