Which Stop-Loss Method Should You Use? A Practical Decision Guide for Traders

After reading multiple stop-loss strategies, most traders ask the same question:

“Which stop-loss method is actually right for me?”

This is where most trading education fails. Traders are taught techniques, but they are never told when to use what. The result is confusion, inconsistency, and emotional decision-making. This guide fixes that.

This article compares every major stop-loss method and maps it to market type, volatility, timeframe, and trader behaviour, so you can stop guessing and start executing with clarity.

Why There Is No “Best” Stop-Loss Method

There is no universally best stop-loss. There is only a best stop-loss for a specific condition. A method that works perfectly in a trending market will fail miserably in a choppy or news-driven environment.

Professional traders adapt stop-loss logic to the market. Retail traders repeat the same mistake everywhere.

The market doesn’t reward consistency of method. It rewards consistency of logic.

Stop-Loss Methods at a Glance

| Stop-Loss Method | Best Use Case | Fails When | Skill Level |

|---|---|---|---|

| Fixed Stop-Loss | Low volatility, scalping | High volatility spikes | Beginner |

| ATR-Based Stop-Loss | Volatile & trending markets | Sideways consolidation | Intermediate |

| Trailing Stop-Loss | Strong trends, momentum | Range-bound markets | Intermediate |

| Structure-Based Stop-Loss | Price action, swing trading | Late entries | Advanced |

| Time-Based Stop-Loss | Momentum & breakout trades | Slow trend development | Intermediate |

| Options Hedge Stop-Loss | High volatility, news events | Low liquidity options | Advanced |

| Automated Stop-Loss | All environments | Only fails if rules are bad | Any level |

Which Stop-Loss Works Best for Which Market?

| Market | Recommended Stop-Loss | Why |

|---|---|---|

| NIFTY / BANKNIFTY | ATR + Trailing + Time SL | High volatility, fast moves |

| Stocks (Intraday) | Fixed / Structure-Based | Lower volatility, clearer levels |

| Commodities (Crude, Gold) | ATR + Time-Based | Event-driven volatility |

| Forex Pairs | Structure + ATR | Smooth trends, technical respect |

| News / Events | Options Hedge | Stops get hunted easily |

Using the wrong stop-loss for the market is worse than not trading at all.

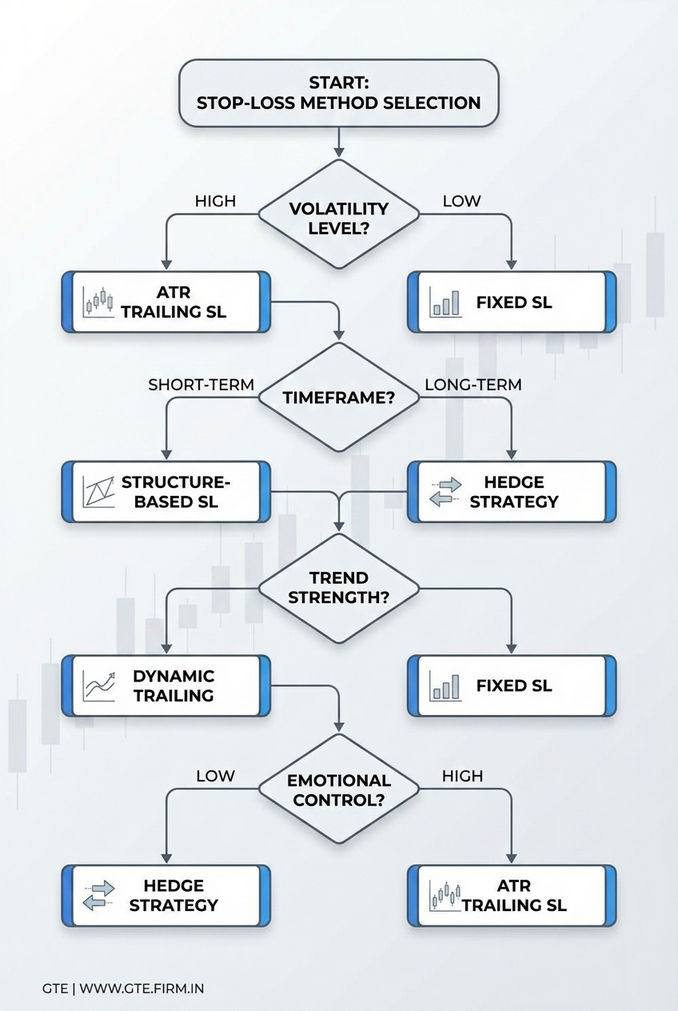

Inline Visual — Decision Framework

A simple logic path removes stop-loss confusion.

The correct stop-loss decision depends on four questions:

- Is the market volatile or calm?

- Is the move expected to be fast or slow?

- Is the trade trend-following or mean-reversion?

- Can emotions be controlled manually?

If the answer to the last question is no, automation is mandatory.

The Trader Type vs Stop-Loss Match

| Trader Type | Best Stop-Loss Approach |

|---|---|

| Beginner | Fixed + Automated Execution |

| Intraday Trader | ATR + Time-Based |

| Swing Trader | Structure-Based + Trailing |

| Event Trader | Options Hedge |

| Emotional Trader | Full Automation |

Your personality matters more than your strategy.

Why Automation Is the Final Layer for Every Method

No matter which stop-loss method you choose, manual execution always breaks under pressure. Fear delays exits. Greed moves stops. Ego overrides logic.

Automation does not choose strategies. It enforces them.

- Fixed SL becomes non-negotiable

- ATR updates dynamically

- Trailing SL adjusts instantly

- Time SL exits without hesitation

- Hedges activate exactly when required

This is why serious traders eventually automate stop-loss execution.

Final Guidance

Stop-loss is not a tool. It is a system.

If you keep changing methods without understanding market context, the problem is not the stop-loss — it is the lack of structure.

Call or WhatsApp us today, or fill the contact form at https://www.gte.firm.in/wp/contact/ to build a stop-loss system customised to your trading style and automate its execution.

FAQs

Is automated stop-loss necessary?

Yes. Manual discipline breaks under real volatility.

Can multiple stop-loss methods be combined?

Yes. Professionals stack logic (ATR + structure + time).

Which stop-loss is safest?

No stop-loss is safe without proper execution and position sizing.