Automated Stop-Loss Execution: Why Algorithms Beat Manual Trading Every Time

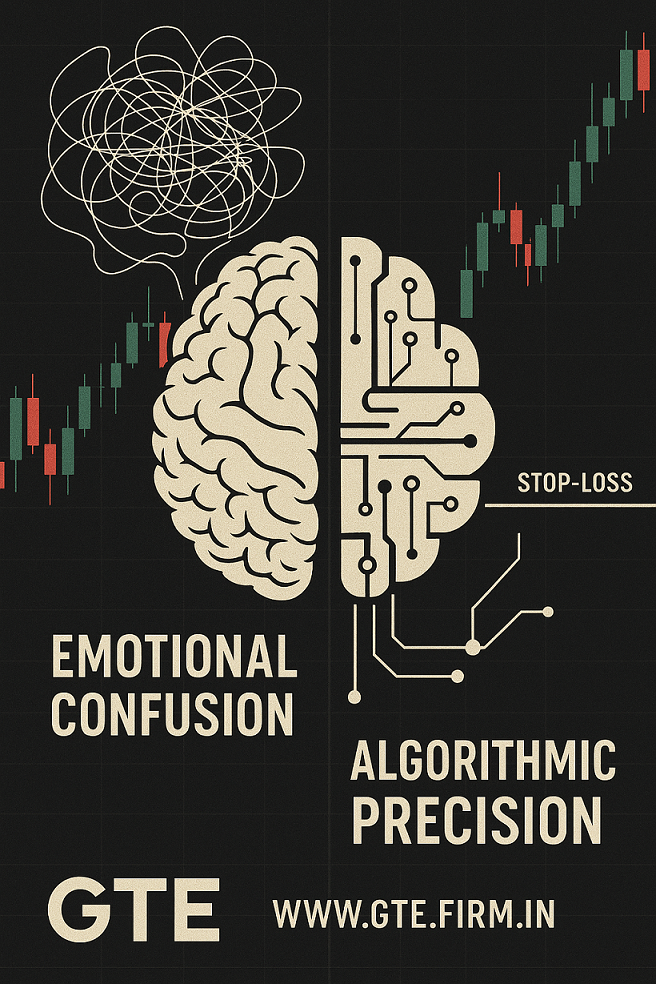

The brutal truth is this: most traders don’t lose because of bad strategy — they lose because they fail to execute stop-loss on time. In real trading, hesitation, ego, fear, greed, and hope destroy discipline. The mind freezes, the hand slows, and by the time the trader reacts, the damage is already done.

Automated stop-loss execution removes human weakness. Once rules are set, the system executes without delay or emotion. No panic. No second guessing. No negotiation with the market.

Manual Execution vs Automated Execution: The Reality Check

| Manual Stop-Loss | Automated Stop-Loss |

|---|---|

| Late reactions | Instant precision execution |

| Emotion-driven override | Zero emotion |

| Panic exit or hope-driven delay | Rule-based logic |

| Massive slippage | Controlled slippage and fixed logic |

| Inconsistent performance | Permanent consistency |

| Undisciplined decision-making | Guaranteed discipline |

Automation enforces the discipline that humans only talk about but rarely follow.

99% of trading disasters begin with the sentence: “I’ll wait just a little longer.” Automation deletes that sentence permanently.

Where Automated Stop-Loss Creates Maximum Advantage

- High-volatility markets (BankNIFTY, Crude, Gold, Natural Gas)

- High-frequency intraday systems

- News-driven price spikes

- High leverage positions where delay is dangerous

- Trailing, ATR, and hedge-based stop-loss strategies

Automation doesn’t wait for fear to act. It acts on time every time.

Real Example: BankNIFTY Volatility Event

Scenario: Sudden spike during RBI announcement

| Trader Type | Exit Timing | Outcome |

|---|---|---|

| Manual SL Trader | Exited 7 seconds late | -₹14,800 loss |

| Automated SL Trader | Exit instantly | -₹3,200 loss |

Difference: ₹11,600 saved on a single trade because execution was instant.

The market moves in milliseconds. Human hands don’t.

Automation Elimination of Emotion

Emotion is the most expensive trading indicator in the world. Automation deletes it.

Without Automated Stop-Loss, Discipline Cannot Survive

- You may place stop-loss — but you won’t execute it consistently

- You may plan risk — but emotions will override plans

- You may analyze perfectly — but analysis is worthless without real execution

Capital is lost in seconds. Discipline is destroyed in milliseconds.

Final Punch

You cannot beat markets with emotions. You can only beat them with automation, discipline, and rule-based execution.

Call or WhatsApp us today, or fill the contact form at https://www.gte.firm.in/wp/contact/ to build automated Stop-Loss execution systems and trade professionally.

FAQs

Do automated stop-loss systems improve profitability?

Yes. They prevent large losses and enforce consistent exits.

Is automation only for advanced traders?

No. Beginners benefit the most because emotions hit them hardest.

Can automation integrate ATR, trailing, time-based, and hedge stop-loss?

Yes. All stop-loss models can be merged into dynamic algo control.