Chartink & Screener Based Trading Automation Systems

We build scanner-driven trading automation systems that convert Chartink and Screener conditions into structured alerts and broker-executable orders — without manual intervention or signal-selling shortcuts.

This service is focused on traders who already use scanners to identify opportunities and want those conditions translated into reliable, rule-based execution pipelines. The emphasis is on correctness, repeatability, and operational control.

Who This Service Is For (And Who It Is Not)

This service is suitable if you:

- Use Chartink or Screener to scan markets systematically

- Want scanner conditions converted into alerts or automated orders

- Understand that scanners generate signals, not guaranteed trades

- Prefer rule-based execution over discretionary decision-making

This service is NOT suitable if you:

- Expect scanners to predict markets with certainty

- Are looking for ready-made signal services or tips

- Want automation without understanding execution risks

- Assume scanners alone can handle position sizing and risk

What We Build Using Chartink and Screener

- Custom scanner logic: Translating your conditions into reliable scanning rules.

- Alert generation systems: Structured alerts via email, Telegram, or other channels.

- Scanner-to-broker automation: Converting validated alerts into broker orders using APIs.

- Execution safeguards: Handling duplicates, market gaps, and order failures.

- Monitoring and logging: Visibility into signal flow and execution status.

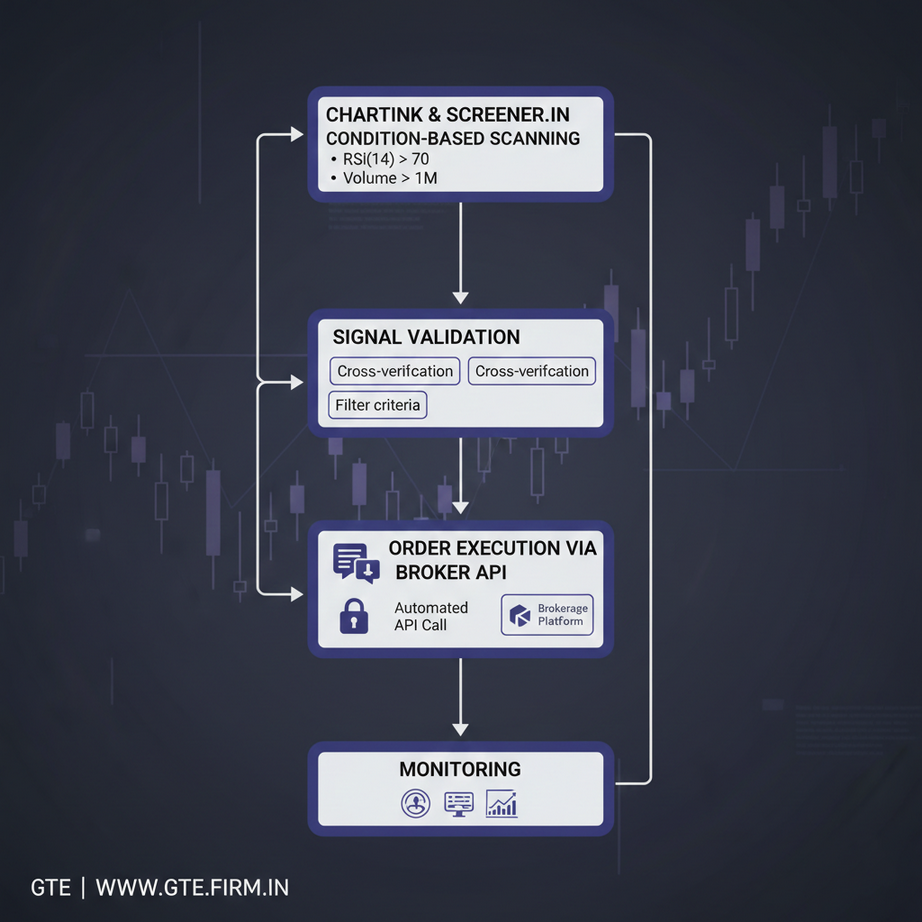

How Scanner-Based Automation Is Implemented

- Scanner condition review and feasibility check

- Rule standardisation and trigger definition

- Alert pipeline and validation logic

- Broker API integration and execution rules

- Live monitoring and exception handling

Important Limitations to Understand

- Scanner signals are condition matches, not trade guarantees

- Execution depends on broker APIs, liquidity, and market timing

- Latency and slippage cannot be eliminated entirely

- Risk management must be defined separately from scan logic

Why Work With Group Technologies & Exports

- System-focused approach instead of signal distribution

- Clear separation between scanning, validation, and execution

- Experience integrating scanners with TradingView and brokers

- Custom-built pipelines, not one-size-fits-all automation

Discuss Your Scanner-Based Trading Requirement

If you want your Chartink or Screener conditions converted into a disciplined, automated trading system, you can get in touch for an initial discussion.

No tips. No predictions. Just structured scanner-based automation.