Trading Signal Generation Systems & Buy / Sell Signal Software

We design and build custom trading signal generation systems that convert defined market logic into structured signals and alerts — without providing market advice, tips, or recommendations.

This service focuses on the engineering side of signal generation: logic definition, signal payload design, validation, and reliable delivery. The signals may be used by individual traders, research desks, or signal-based businesses, but the trading decisions and responsibility always remain with the client.

Who This Service Is For (And Who It Is Not)

This service is suitable if you:

- Have clearly defined rules for generating buy, sell, or exit signals

- Run or plan to run a signal-based trading or advisory business

- Want consistent, rule-based alerts instead of manual interpretation

- Need scalable signal delivery for one or multiple users

This service is NOT suitable if you:

- Are looking for trading tips, calls, or discretionary recommendations

- Expect signals to guarantee profits or eliminate losses

- Do not have defined logic behind the signals

- Want software to replace risk understanding or decision-making

What Signal Generation Means in Practice

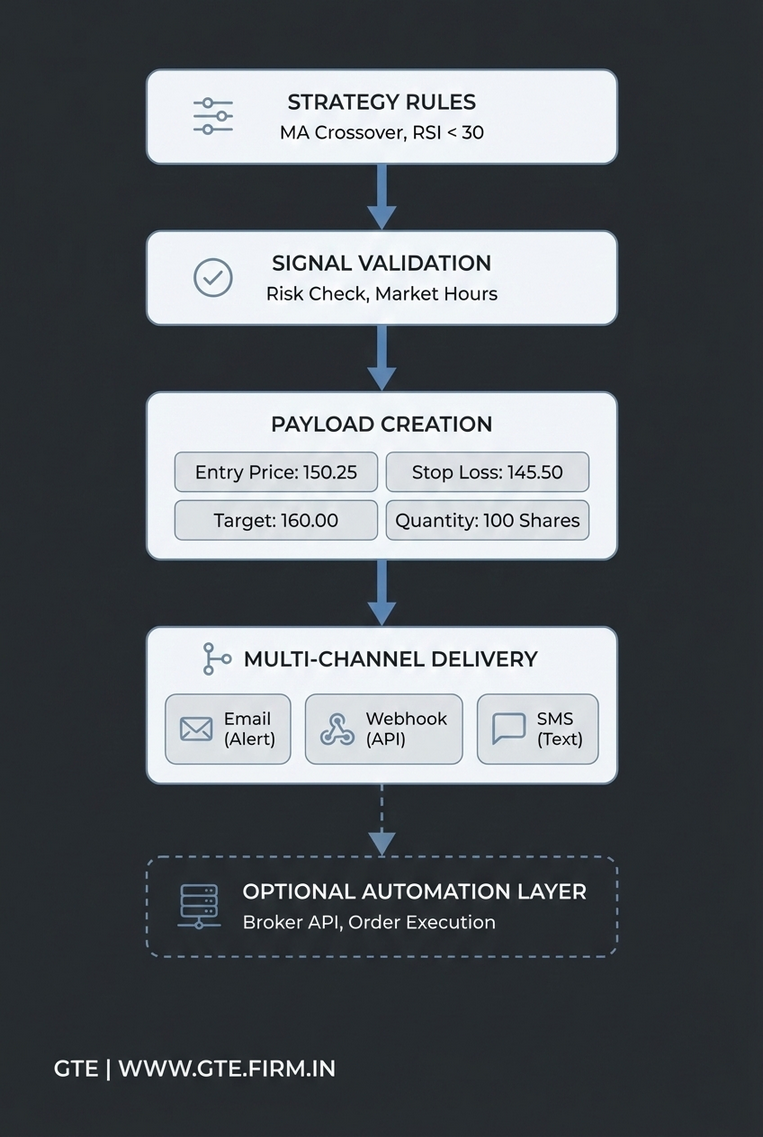

A trading signal is the output of predefined conditions — not advice. Our systems generate signals when market data matches the logic supplied by you. The signal simply communicates that a condition has occurred.

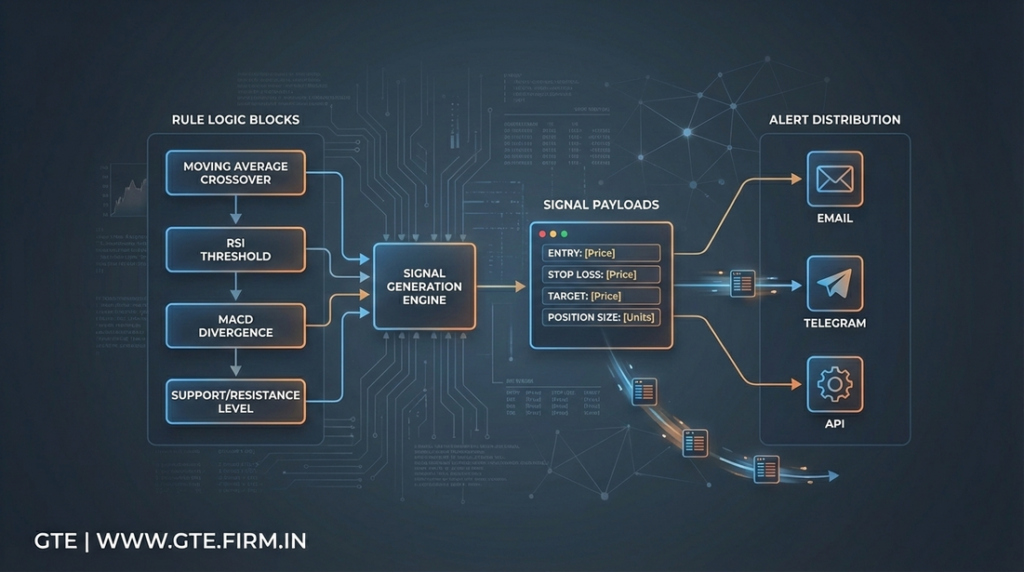

Signals can be designed to include structured information such as:

- Trade direction (buy, sell, exit)

- Entry conditions or reference price

- Stop-loss and target logic

- Position sizing or risk parameters

- Instrument, timeframe, and validity context

Types of Signal Systems We Build

- Indicator-based signals: Signals derived from technical indicators and rule combinations.

- Scanner-based signals: Condition-driven signals using scanners such as Chartink or Screener.

- Multi-condition confirmation signals: Signals requiring alignment across timeframes or factors.

- Portfolio-aware signals: Signals that consider exposure, limits, or user-level constraints.

Signal Delivery & Integration Options

- Email and messaging alerts (including Telegram)

- Webhook-based delivery for external systems

- TradingView alert integration

- Integration-ready payloads for execution engines

How Signal Systems Are Designed

- Logic and condition definition

- Signal validation and filtering rules

- Payload structure and parameter design

- Delivery channel configuration

- Monitoring and exception handling

Important Limitations to Understand

- Signals indicate conditions, not outcomes

- False signals are inevitable in changing market regimes

- Execution quality depends on the downstream system

- Risk management must be defined independently of signal logic

From Signals to Full Automation

Signal generation is often the first step. For clients who want to move further, these systems can feed directly into automated execution layers that handle order placement, position sizing, and broker-specific logic.

This allows a clear separation between signal logic and execution responsibility, reducing operational risk.

Why Work With Group Technologies & Exports

- Clear separation between infrastructure and advisory responsibility

- Experience building scalable, multi-user signal systems

- Strong focus on reliability, structure, and auditability

- Ability to extend signal systems into full automation when required

Discuss Your Signal Generation Requirement

If you have defined logic for generating trading signals and want it implemented as a reliable, scalable system, you can get in touch for an initial discussion.

Signal infrastructure. Not advice. Not predictions.